Difference between revisions of "2768: Definition of e"

(→Explanation) |

(too wordy originally) |

||

| (41 intermediate revisions by 33 users not shown) | |||

| Line 10: | Line 10: | ||

==Explanation== | ==Explanation== | ||

| − | + | In this comic the teacher [[Miss Lenhart]] is asked by the student [[Hairy]] to explain what the constant ''e'' actually means. | |

| − | The mathematical constant ''{{w|e (mathematical constant)|e}}'' | + | |

| + | The mathematical constant ''{{w|e (mathematical constant)|e}}'' is known as Euler's number. It is typically demonstrated in terms of compound interest. Here, Miss Lenhart seems to be setting up such an example, but in a typical Lenhart style she is actually asking her student to give her money. | ||

| + | |||

| + | The constant ''e'' can be described {{w|E (mathematical constant)#Compound interest|in the context of compound interest}}. For a bank account that pays interest at a rate of 100% per year, and that interest is paid ''n'' times a year and compounded, then a $1 deposit will grow to $1 * (1 + 100%''/n'')^''n'' after a year. As ''n'' approaches infinity (continuous compounding), the amount approaches ''e'' dollars. In the comic, minutely compounding is used as an approximation of continuous compounding; here ''n'' = 365 * 24 * 60 = 525,600 (527,040 for leap years with 366 days), and the resulting amount would be $2.7182792…, less than one part per million different from that of a straight multiplication by ''e'' (which is 2.7182818…). | ||

| + | |||

| + | As such, one would expect Miss Lenhart to say in the last panel something like "you'll have ''e'' dollars in a year". The joke here is that she instead uses the normal beginning phrase ("If you have $1...") and turns it into a charge to answer the question ("I will answer your question.") | ||

| + | |||

| + | In the title text, Randall remembers that his high school teacher, like Miss Lenhart in the comic, had a bank account that paid 100% annual interest. This is an extremely high rate, and a bank that is able to offer it must have a very lucrative source of revenue. Therefore, he bought the bank, via a {{w|Takeover#Hostile|hostile takeover}}, in order to gain direct access to that source, and now uses it as a source of supplementary income. It is unlikely that this story is true.{{cn}} | ||

| + | |||

| + | It is also plausible that the title text is Miss Lenhart explaining how she acquired the bank to set up her account there, and that she regularly charges people $1 for trivial services, such as explaining concepts to her students. | ||

==Transcript== | ==Transcript== | ||

| − | + | :[Hairy is seated behind a classroom desk with his hand raised asking the teacher Miss Lenhart a question. She is standing in front of him with a board behind her. Beneath the board there are ledge with writing tools on it (markers or chalk).] | |

| − | + | :Hairy: Can you explain what the constant ''e'' actually ''means?'' | |

| − | :[Hairy is seated | ||

| − | :Hairy: Can you explain what the constant ''e'' actually ''means'' | ||

:Miss Lenhart: Sure. | :Miss Lenhart: Sure. | ||

| + | :[Zoom in on Miss Lenhart's upper half, as she raises one hand palm up.] | ||

:Miss Lenhart: I have a bank account that pays 100% annual interest, compounded every minute. | :Miss Lenhart: I have a bank account that pays 100% annual interest, compounded every minute. | ||

| + | :[In a frame-less, and very slim panel, Miss Lenhart is shown holding a hand up with one finger raised.] | ||

:Miss Lenhart: If you deposit $1 now, | :Miss Lenhart: If you deposit $1 now, | ||

| + | :[Miss Lenhart now has both arms down as she continues to address the off-panel Hairy.] | ||

:Miss Lenhart: I will answer your question. | :Miss Lenhart: I will answer your question. | ||

| + | {{comic discussion}} | ||

| + | |||

| + | [[Category:Comics with lowercase text]] | ||

[[Category:Comics featuring Hairy]] | [[Category:Comics featuring Hairy]] | ||

[[Category:Comics featuring Miss Lenhart]] | [[Category:Comics featuring Miss Lenhart]] | ||

[[Category:Math]] | [[Category:Math]] | ||

| − | |||

| − | |||

Latest revision as of 13:47, 11 October 2024

| Definition of e |

Title text: Yeah, my math teacher back in high school set up the system to try to teach us something or other, but the 100% rate was unbelievably good, so I engineered a hostile takeover of his bank and now use it to make extra cash on the side. |

Explanation[edit]

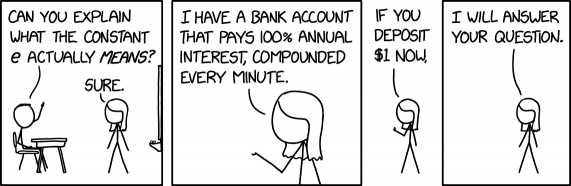

In this comic the teacher Miss Lenhart is asked by the student Hairy to explain what the constant e actually means.

The mathematical constant e is known as Euler's number. It is typically demonstrated in terms of compound interest. Here, Miss Lenhart seems to be setting up such an example, but in a typical Lenhart style she is actually asking her student to give her money.

The constant e can be described in the context of compound interest. For a bank account that pays interest at a rate of 100% per year, and that interest is paid n times a year and compounded, then a $1 deposit will grow to $1 * (1 + 100%/n)^n after a year. As n approaches infinity (continuous compounding), the amount approaches e dollars. In the comic, minutely compounding is used as an approximation of continuous compounding; here n = 365 * 24 * 60 = 525,600 (527,040 for leap years with 366 days), and the resulting amount would be $2.7182792…, less than one part per million different from that of a straight multiplication by e (which is 2.7182818…).

As such, one would expect Miss Lenhart to say in the last panel something like "you'll have e dollars in a year". The joke here is that she instead uses the normal beginning phrase ("If you have $1...") and turns it into a charge to answer the question ("I will answer your question.")

In the title text, Randall remembers that his high school teacher, like Miss Lenhart in the comic, had a bank account that paid 100% annual interest. This is an extremely high rate, and a bank that is able to offer it must have a very lucrative source of revenue. Therefore, he bought the bank, via a hostile takeover, in order to gain direct access to that source, and now uses it as a source of supplementary income. It is unlikely that this story is true.[citation needed]

It is also plausible that the title text is Miss Lenhart explaining how she acquired the bank to set up her account there, and that she regularly charges people $1 for trivial services, such as explaining concepts to her students.

Transcript[edit]

- [Hairy is seated behind a classroom desk with his hand raised asking the teacher Miss Lenhart a question. She is standing in front of him with a board behind her. Beneath the board there are ledge with writing tools on it (markers or chalk).]

- Hairy: Can you explain what the constant e actually means?

- Miss Lenhart: Sure.

- [Zoom in on Miss Lenhart's upper half, as she raises one hand palm up.]

- Miss Lenhart: I have a bank account that pays 100% annual interest, compounded every minute.

- [In a frame-less, and very slim panel, Miss Lenhart is shown holding a hand up with one finger raised.]

- Miss Lenhart: If you deposit $1 now,

- [Miss Lenhart now has both arms down as she continues to address the off-panel Hairy.]

- Miss Lenhart: I will answer your question.

Discussion

This is of course one way of arriving at the value of e: https://en.wikipedia.org/wiki/E_(mathematical_constant)#Compound_interest Trimeta (talk) 03:55, 27 April 2023 (UTC)

I do not know who said that Miss Lenhard is after a dollar - but that is so not her!Tier666 (talk) 09:15, 27 April 2023 (UTC)

One explanation may be that Miss Lenhart is in a Ponzi scheme. Ponzi schemes claim to offer unbelievably high returns that are actually paid by later investors, it will invariably crash, but by the time, the scammers will have vanished with the money. Here, Miss Lenhart effectively offers +172% annual returns, which is way above what a honest bank can offer, and she seems to push the student into investing, which is aligned with the Ponzi scheme goal of getting as many people to invest as possible. 162.158.22.234 11:25, 27 April 2023 (UTC)

e^iπ + 1[edit]

e is an inherent feature of mathematics. The equation e^iπ + 1 = 0 is made of the 5 most important numbers. - Frankie (talk) 13:10, 27 April 2023 (UTC)

- i is not a number, it is the imaginary unit. SDSpivey (talk) 16:00, 27 April 2023 (UTC)

- i is a number. 1 is also sometimes called the unit by mathematicians. 172.71.22.105 21:01, 27 April 2023 (UTC)

- Every number is an inherent feature of mathematics, but I don't think the number e is as special as formulas like this make it appear. What's really significant is the exponential function exp, and the number e is just exp 1. It is therefore similar in significance to √2 or ln 2. Similarly, in the identity you provide, the general form is exp iθ = cos θ + i sin θ, and plugging in θ = π is just one special case. EebstertheGreat (talk) 02:33, 28 April 2023 (UTC)

- e^ipi is genuinely quite boring. I would prefer e^i2pi = e^0 = 1 because its more immediately apparent that e^ix forms a circle/periodic function172.69.33.225 06:29, 28 April 2023 (UTC)

Does anyone else see the buttons at the top as being weird? The first comic arrow is split into two buttons separated by a new line. 172.70.38.17 12:24, 27 April 2023 (UTC)

Maybe the bank was originally owned by Beret Guy? That would explain why it continues to stay in business despite effectively giving away money. It's not suggested anywhere in the comic, but the idea is very much in line with his powers. 162.158.158.137 13:40, 27 April 2023 (UTC)

The current explanation is vague regarding the identity of the speaker in the title text, but it seems clear to me that the title text is being said by Miss Lenhart - she's explaining how she came into possession of the bank account in question. Her high school teacher set it up, and then she engineered the takeover so she could continue to use the account after passing the class. Snuffysam (talk) 16:12, 27 April 2023 (UTC)

r = n * (2^(1/n) - 1)[edit]

This demonstrates a misunderstanding of the way banks, and other financial institutions, quote interest rates. A bank that pays 100% interest rate annually, will pay $1 on 1$: at the end of the first year the balance will be $2.00. That is not (1+100%/n)**n, and is not $2.71, because the interval compounding rate is not 100%/n for n <>1. The interval compounding rate for 100% per annum is r = n * (2^(1/n) - 1). I leave working out the limit as n approaches infinity as an exercise for the reader :) I don't know if math teachers in the USA actually use this example as a math teaching method: if so, they should certainly have a discussion with a 'business studies teacher' or 'business math teacher' about the meaning of the words they are using, because they are doing a disservice to students by misleading them about the meaning of common savings and loan terms of business.

- This would mean there is no difference between interest “compounded annually” vs. “compounded daily”? Also, deleted the last paragraph of the exp. Seems clear to me that the title text speaker is the student in the strip, later relating the very incident illustrated. (And no need for comment on characters’ future business endeavors.) Miamiclay (talk) 10:58, 4 May 2023 (UTC)

- Unremoved the last para. The teacher deecribed is male, Miss L is not.[citation needed] But if the suggestion is that the narrating person is Miss L (after the year has passed?), then we have other problems to explain (how she thinks she got it to work, hypercompetent as she is but as impossible the setup is).

- I read it as someone else, off-panel (traditionall Randall's voice, but not in this case?), who is describing a different time and who clearly didn't/doesn't grasp reality (did not get taught/listen that well, at school, seems convinced they did something clever), or can actually ignore the problems (like Beret Guy). But it could do with streamlining. Or various brief arguments for and against who is saying it, split up. 172.70.162.161 12:35, 4 May 2023 (UTC)

- I initially (mis?)read “his bank” as reflecting not ownership, but where he banked, but you’re probably right. Either way, the whole thing seems both unclear as to the referents and somewhat misconceived - When a bank pays absurdly high rates, the last thing one would want is to acquire it! Miamiclay (talk) 15:09, 4 May 2023 (UTC)

- The difference between "compounded annually" and "compounded monthly" was/is that "compounded monthly" is computed on the "minimum monthly balance". Savings banks moved to "compounded daily" when computers meant that the work involved wasn't completely unreasonable. With "compounded daily", you get paid interest even if you have one day in the month when the balance was $0.01 and all the other days were $100K.

- If you are buying a 90 day bond, the interest really is quoted as n*90/365 (or n*90/360, or n*90/366 or %90/90, depending on the exchange rules). And if you re-invest, you get more. And you can do the same with over-night money (daily rollover). But that's "re-investment", not "daily-compounding". And the thing is, working out "true cost" is difficult for most people, and most people don't know and haven't thought about what "daily compounding" is, and probably wouldn't understand the math if they do think about it. It's easy to believe that teachers are miss-using the business terms used for ordinary savings accounts, but if so, that's unfortunate.

As it stands, this explanation smacks of taking the fictional scenario way too literally. It spends a lot of words deconstructing the idea of "100% annual interest", instead of explaining the comic. My interpretation is that we're meant to take the 100% at face value: it shouldn't work, but it does. -- Peregrine (talk) 01:41, 6 May 2023 (UTC)

It's just the difference between measuring interest in APY and APR. A 100% rate compounded every minute has a 172% yield. The teacher must be talking about rate, because that's the only way to get $e at the end. EebstertheGreat (talk) 03:32, 14 May 2023 (UTC)

-- -- --

[In response to the top comment in this section]

No, that's not what "interest rate" typically means in the US. In the US, when a rate is quoted as an "annual interest rate", the rate quoted is merely a nominal amount, and when compounded at the specified compounding frequency over the course of a year will yield slightly more interest than the quoted nominal rate. What you have described would be called the "annual percentage yield" ("APY") in the US. To be clear: in the American usage of "interest rate", three elements are needed to properly specify the interest: 1) the nominal rate, 2) the length of time over which that rate would accrue at simple interest (i.e., the word "annual" in "100% annual interest" in the comic), and 3) the compounding period. However, it's traditional to quote annual rates, and I believe there are rules on compounding periods (I think it has to be daily, but not sure).

If you don't believe me, check out this primer on the Truth in Savings regs, put out by the Federal Reserve: https://www.federalreserve.gov/boarddocs/caletters/2009/0914/09-14-attachment.pdf , e.g. the APY description on page 2. Or this CNN article: https://www.cnn.com/cnn-underscored/money/apy-vs-interest-rate

Now that's for deposits, as in the comic. For loans, we have the term "annual percentage rate", which, while sounding close to "annual percentage yield", is actually used in the same way as "interest rate" as I described above (that is, to find the actual interest charged over the compounding period you simply divide the nominal rate by the number of periods in a year). The difference between "interest rate" and "APR" is that fees have to be rolled into the APR calculation, to give a better sense of total cost of borrowing money. To be clear -- APR and APY are pretty different, mathematically speaking, suggesting that Americans interpret "rate" to be a nominal amount that won't compound to the quoted amount, while we interpret "yield" to be the effective amount that does compound to the quoted amount. And lest anyone feel otherwise, these usages are not "wrong" (or right, for that matter), they're merely convention.

All that said, most banks nowadays specifically quote only the APY for deposits (not surprising, since it's the bigger number and bigger looks better to the customer when you're talking interest crediting). So for that reason, you're correct that this XKCD is a bit misleading -- you don't ever see banks talking about the "interest rate" on deposits anymore; e.g. go to BankRate.com and you'll see a list of various banks' APY's -- labeled as such. But the comic is not wrong about the meaning of "annual interest rate".

The example in the comic would work better with a loan than with a deposit, because banks do typically use "annual interest rates" when quoting loans, but then he'd need to change the joke in the mouseover text.

162.158.159.103 (talk) 23:58, 28 December 2023 (please sign your comments with ~~~~)

-- -- --

Cut down the explanation of the title text. It was long, contradictory, and, I would argue, wrong. Jkshapiro (talk) 02:28, 10 April 2024 (UTC)

only if she gives it back! --[insert signature here] (talk) 01:19, 25 March 2025 (UTC)

My read of this comic: Trying to explain e without using calculus is rather like trying to explain pi without using circles. The "compound interest" explanation has never held water for me. 68.42.184.67 10:28, 30 July 2025 (UTC)