1566: Board Game

| Board Game |

Title text: Yes, it took a lot of work to make the cards and pieces, but it's worth it--the players are way more thorough than the tax prep people ever were. |

Explanation[edit]

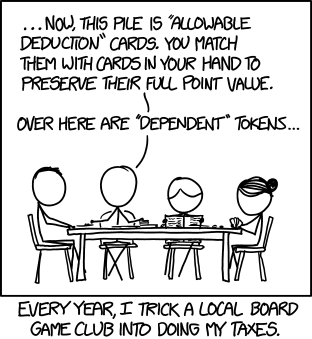

In this comic, Cueball is shown explaining the rules of a board game to three other players (Hairy, Ponytail, and Hairbun) of a local board game club – a hobbyist group that gets together to play board games. However, the board game Cueball is explaining is actually his own creation which is designed to trick the club into preparing his income tax return. The caption indicates that Cueball does this every year, which makes this comic reminiscent of the My Hobby series.

An income tax return is an annual document which most adults (and some teenagers) in many countries must prepare and submit to the government agency responsible for tax collection. The document sets out that person's income for the year, along with offsets including deductions and credits, and calculates the amount of income tax the person is required to pay to the government (used by the revenue service to compare it to the value that person had actually paid). The return requires understanding of a number of forms which may seem complicated to those not familiar with them. It is an annual task that is stereotypically met with confusion and disdain. Many people hire professionals to prepare their taxes. More recently, software-based solutions that walk the user through a series of more understandable text-based questions are available to aid taxpayers in completing their returns. However these are not always ideal for those with complicated returns.

In this comic, Cueball has developed his alternative method of tax preparation which utilizes the collective intelligence of several board-game-club players, and also capitalizes on the fact that members of such a club are likely very competitive and eager to succeed at board games. As a result (as the title text suggests), Cueball thinks the board game players are more thorough than the tax preparation professionals he has previously used. Such professionals would prepare perhaps hundreds of returns per year and as a result, might indeed be less thorough with each individual return which may all be viewed as fairly simple and repetitive by the professional.

Among the rules Cueball explains are references to "allowable deduction" cards which presumably reference certain deductions which are allowed on income tax returns to lower the net income (resulting in lower taxes). For example; a portion of certain medical expenses are permitted to lower one's income in recognition of the fact that using one's income for medical expenses is somewhat non-discretionary. Similarly, certain charitable donations are permitted as deductions to encourage such donations.

In Cueball's game, players must match the deductions with other cards to preserve their full "point value". This appears to be a reference to the desire to capitalize as much as possible on the value of a deduction by taking the deduction against income which would otherwise incur the greatest tax, and ensuring that the full amount of the deduction can be used. A deduction of $2,000 against income of $1,000 would waste half the deduction.

In gaming, tokens are small playing pieces which may represent various things, depending on the game. In many board games (e.g. Monopoly), tokens represent the players themselves. In other games, such as Magic: The Gathering, tokens can represent creatures or other items in a player's inventory. Cueball references "dependent tokens" which appear to be game tokens representing Cueball's dependents. Dependents are individuals for whom the taxpayer is entitled to certain deductions and credits, often related to expenses incurred to care for the dependents. Most commonly, dependents are the minor children whom the taxpayer is required to support financially, but in the United States (where Randall lives) a person can claim a qualifying child as a dependent as long as the qualifying child lives with the claimant and is not self-supporting, even if the claimant is not the person who supports the qualifying child, and a person who voluntarily supports another (without being required) may also qualify to claim the person. Also, U.S. law usually does not allow a person's own spouse to be claimed as a "dependent", even when financial support is required.

Note that while Cueball states he "tricks" his board game club into doing his taxes, in fact his use of clear tax terms ("allowable deductions", "dependent") for naming different tokens and elements of the game could suggest that the players knew what he was doing but going along with it because they just enjoy playing board games, such that even doing a tax return – often considered a boring mind-numbing chore – within the format of a board game would be something they would enjoy doing. (On the other hand, it's possible that the players don't realize that the game involves preparing Cueball's own tax return.) Alternatively, the comic may be comparing the tediousness of some board games to that of doing tax returns. It is noted that there are board games on a variety of unexpected topics which might seem like boring subjects for a game. For example, there are several games designed to simulate the stock market and investing. The popular video game Farmville is often joked about having created a successful game out of a job most people would find unpleasurable. This suggests it might actually be possible to create an board game enjoyable to some people from the process of preparing a tax return.

This is one of several xkcd comics that suggest going to comically extreme lengths to avoid doing something (in this case, his taxes) that might have been simpler to do normally than the way Randall proposes. In this case, Cueball suggests that his motives may actually be to get the most thorough preparation possible, rather than to simply find a way to get the task done. There is actually a pretty solid basis to for this. Both gamification and crowdsourcing have been shown, in at least some cases, to produce results that can match or exceed those produced by professionals. For example, the University of Washington created an online game in which users tried to optimize the folding of protein structures. The results produced by players produced useful new structures more quickly than computer simulations were able to. In this case, the work is being done by people who presumably have at least some enthusiasm for games, and who are likely competing with one another for the best results. Randall can then use the best outcome (that created by the winner) to optimize his own tax return.

A similar situation of Randall secretly exploiting someone's interest for his own purposes occurs in 1323: Protocol, and another board game can be found at 492: Scrabble. This was the first time Randall made a comic about people having trouble understanding the US tax system. Since then he has two years in a row made comics in relation to an approaching tax day. See the title text of 1805: Unpublished Discoveries and the entire comic 1971: Personal Data.

Transcript[edit]

- [Hairy, Cueball, Ponytail (reading something), and Hairbun (holding some cards) are sitting around a table. There are several other objects on the table.]

- Cueball: ...Now, this pile is "allowable deduction" cards. You match them with cards in your hand to preserve their full point value.

- Cueball: Over here are "dependent" tokens...

- [Caption below the frame:]

- Every year, I trick a local board game club into doing my taxes.

Discussion

I think Cueball has mastered gamification and crowdsourcing. --Koveras (talk) 12:45, 19 August 2015 (UTC)

Unfortunately the rules change every year and explaining the rules would probably take close to a year. The Feds really should supply free tax prep software to the masses. 108.162.216.100 13:45, 19 August 2015 (UTC)

- Not going to happen. Guess who's lobbying against it? Ralfoide (talk) 16:27, 19 August 2015 (UTC)

Someone needs to make an actual board game based on this comic. Any aspiring or wanna be board game makes out there? 173.245.54.149 15:44, 19 August 2015 (UTC)

- Upvote* That's right, Jacky720 just signed this (talk | contribs) 10:05, 2 May 2017 (UTC)

I think the title "Board Game" could imply a double meaning since doing taxes is such a chore. Hence, the homophone bored. Also, paragraph 4b is an assumption. We don't know Cueball's actual reasoning for tricking board game hobbyists into doing his taxes. Perhaps he is cheap and doesn't want to pay a professional. Perhaps it is an experiment. IMO it wouldn't be because it is too confusing because he would need to thoroughly understand the rules in order to explain them, thus leaving him fully qualified to complete it personally. I think the fave value explanation is just laziness. Same reason I hire someone to cut my grass. --R0hrshach (talk) 16:30, 19 August 2015 (UTC)

I disagree with the paragraph "Note that while Cueball states he "tricks" his board game club ... the players knew what he was doing but going along with it ...". They obviously know they are playing a tax return game, but presumably he has not told them that the cards and tokens they are getting match Cueball's actual situation in real life. So, they are tricked into preparing his actual return while thinking they are just playing a simulation game. Zetfr 20:43, 19 August 2015 (UTC)

This kind of reminds me of when they made a Magic: The Gathering turing machine. http://www.toothycat.net/~hologram/Turing/ Just replace "Magic" with "Cueball's tax board game" and "Calculating anything a turing machine can" with "Doing my taxes."108.162.219.48 03:18, 20 August 2015 (UTC)

"This is one of several xkcd comics" should include links to examples EHusmark (talk) 09:52, 20 August 2015 (UTC)

Its a shame that so many people resort to such ludicrous methods every day to do their income taxes. End Tax Discrimination Yourlifeisalie (talk) 14:33, 20 August 2015 (UTC)

This right here is one of the big reasons I'm glad to have been born and raised in the UK. Automatic, systematic tax calculations - including the occasional refund when the error-detection system finally sweeps round to your particular record (not sure if they ever issue demands if the error is in the other direction, though...) - for everyone except the self-employed. Naturally this means any business over a trivial size needs some kind of accounts and payroll department to deal with all the sums, but you should have that anyway.

IE just do your job and collect your pay, the tax is taken off on a per-paycheque basis with nothing more needing to be done on your behalf unless you spot a glaring error (such as the dreaded "emergency tax" band if the employer forgets to inform the authorities that you've taken up a new job at their company and what your annual salary is likely to be, so instead they detect you're suddenly getting a lot of regular income and apply the highest possible deductions in case you've taken up as a high-rolling drug dealer or something...). All taxes, national healthcare, pension, union etc contributions come out of the packet before it even hits your bank account, any errors are assumed to be someone else's fault, and even the "emergency" things are *eventually* flagged and dealt with by the system (even if it might take a year or two) so you don't get _permanently_ bilked of what you're rightly owed. So you don't end up with those clever enough and evil enough being able to game the system to minimise their tax bill even in some unethical ways, whilst a dyscalculic day labourer having to do two jobs to feed their kids gets bent over a barrel. 141.101.106.113 12:39, 9 October 2015 (UTC)