Difference between revisions of "1566: Board Game"

m (removed Category:Comics featuring Megan using HotCat) |

m (added Category:Comics featuring Hair Bun Girl using HotCat) |

||

| Line 23: | Line 23: | ||

[[Category:Comics featuring Cueball]] | [[Category:Comics featuring Cueball]] | ||

[[Category:Comics featuring Hairy]] | [[Category:Comics featuring Hairy]] | ||

| + | [[Category:Comics featuring Hair Bun Girl]] | ||

Revision as of 13:24, 19 August 2015

| Board Game |

Title text: Yes, it took a lot of work to make the cards and pieces, but it's worth it--the players are way more thorough than the tax prep people ever were. |

Explanation

| This is one of 60 incomplete explanations: Created by a BOT - Please change this comment when editing this page. If you can fix this issue, edit the page! |

Transcript

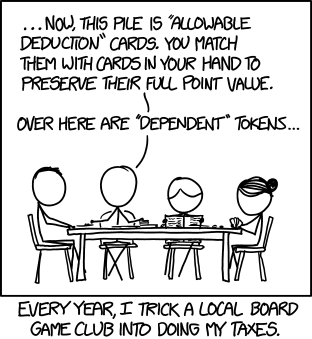

Four people are sitting around a table. From left to right, Hairy, Cueball, Ponytail (reading something), and Hair Bun Girl (holding some cards). Other small objects are on the table.

Cueball: "...Now, this pile is 'allowable deduction' cards. You match them with cards in your hand to preserve their full point value.

Over here are 'dependent' tokens..."

Under picture: "Every year, I trick a local board game club into doing my taxes."

Discussion

I think Cueball has mastered gamification and crowdsourcing. --Koveras (talk) 12:45, 19 August 2015 (UTC)

Unfortunately the rules change every year and explaining the rules would probably take close to a year. The Feds really should supply free tax prep software to the masses. 108.162.216.100 13:45, 19 August 2015 (UTC)

- Not going to happen. Guess who's lobbying against it? Ralfoide (talk) 16:27, 19 August 2015 (UTC)

Someone needs to make an actual board game based on this comic. Any aspiring or wanna be board game makes out there? 173.245.54.149 15:44, 19 August 2015 (UTC)

- Upvote* That's right, Jacky720 just signed this (talk | contribs) 10:05, 2 May 2017 (UTC)

I think the title "Board Game" could imply a double meaning since doing taxes is such a chore. Hence, the homophone bored. Also, paragraph 4b is an assumption. We don't know Cueball's actual reasoning for tricking board game hobbyists into doing his taxes. Perhaps he is cheap and doesn't want to pay a professional. Perhaps it is an experiment. IMO it wouldn't be because it is too confusing because he would need to thoroughly understand the rules in order to explain them, thus leaving him fully qualified to complete it personally. I think the fave value explanation is just laziness. Same reason I hire someone to cut my grass. --R0hrshach (talk) 16:30, 19 August 2015 (UTC)

I disagree with the paragraph "Note that while Cueball states he "tricks" his board game club ... the players knew what he was doing but going along with it ...". They obviously know they are playing a tax return game, but presumably he has not told them that the cards and tokens they are getting match Cueball's actual situation in real life. So, they are tricked into preparing his actual return while thinking they are just playing a simulation game. Zetfr 20:43, 19 August 2015 (UTC)

This kind of reminds me of when they made a Magic: The Gathering turing machine. http://www.toothycat.net/~hologram/Turing/ Just replace "Magic" with "Cueball's tax board game" and "Calculating anything a turing machine can" with "Doing my taxes."108.162.219.48 03:18, 20 August 2015 (UTC)

"This is one of several xkcd comics" should include links to examples EHusmark (talk) 09:52, 20 August 2015 (UTC)

Its a shame that so many people resort to such ludicrous methods every day to do their income taxes. End Tax Discrimination Yourlifeisalie (talk) 14:33, 20 August 2015 (UTC)

This right here is one of the big reasons I'm glad to have been born and raised in the UK. Automatic, systematic tax calculations - including the occasional refund when the error-detection system finally sweeps round to your particular record (not sure if they ever issue demands if the error is in the other direction, though...) - for everyone except the self-employed. Naturally this means any business over a trivial size needs some kind of accounts and payroll department to deal with all the sums, but you should have that anyway.

IE just do your job and collect your pay, the tax is taken off on a per-paycheque basis with nothing more needing to be done on your behalf unless you spot a glaring error (such as the dreaded "emergency tax" band if the employer forgets to inform the authorities that you've taken up a new job at their company and what your annual salary is likely to be, so instead they detect you're suddenly getting a lot of regular income and apply the highest possible deductions in case you've taken up as a high-rolling drug dealer or something...). All taxes, national healthcare, pension, union etc contributions come out of the packet before it even hits your bank account, any errors are assumed to be someone else's fault, and even the "emergency" things are *eventually* flagged and dealt with by the system (even if it might take a year or two) so you don't get _permanently_ bilked of what you're rightly owed. So you don't end up with those clever enough and evil enough being able to game the system to minimise their tax bill even in some unethical ways, whilst a dyscalculic day labourer having to do two jobs to feed their kids gets bent over a barrel. 141.101.106.113 12:39, 9 October 2015 (UTC)

- Wait... so in America they DON'T just pay their taxes through their normal paycheck?? 2a0a:ef40:f72:7301:3385:c08:15d2:f35e (talk) 08:45, 12 November 2025 (please sign your comments with ~~~~)

- It surprised me too, when I got the fuller detail. Beyond the "I've got to do my taxes, this week"-episodes of various US dramas/comedies, where you're perhaps at first assuming that these individuals have the more complicated personal finances that means PAYE doesn't just silently shave it off and significant extra needs to be paid/reimbursed only upon application.

- Then there's finding (when you wander over the pond and go into a shop) the tendency for every price-label to have different values for with and without various taxes. As opposed to normally only seen in trade/wholesale-orientated outlets where they show the "ex-VAT" price for the benefit of those who will need to consider the post-reimbursement cost by the time the accounts get settled.

- But apparently everyone is used to it. And there's a whole industry reliant upon (almost all) wage-earners needing at least a little help (in person, by software or through some sort of instruction manual updated every year for every jurisdiction) rather than a simple tax-code sufficing to deal with most of the wages issues via their employer's accounts department.

- ...or so my friends and colleagues, from across the pond, tell me. Plus there's that time I had to fill in a WD40 (no, wait, that's a lubricating spray... Whatever the US tax form for furriners is...) when I needed to once receive a trivial bit of income from the US head office rather than my 'home' site of my international company. 82.132.245.237 (talk) 16:15, 12 November 2025 (please sign your comments with ~~~~)

- Here's your answer from someone in the United States of Crappy Politics (USCP): Everything here in relation to the government is an absolute shitshow here. There is an industry, and it's VERY VERY VERY VERY VERY big. Need to file an insurance claim via Medicare (crappy government health insurance)? Takes about two months. Need to file your taxes? That takes at least a couple weeks and a LOT of paperwork. Pro tip: FOR THE LOVE OF GOD SAVE YOURSELVES FROM OUR FREE-MARKET CORPORATE HELLSCAPE.

- Although, I have literally never seen two prices for a product in my 14.5 years of living here. If they did that, the customers would be able to see how much money they're spending and Amazon would gain $30 billion instead of $30.01 billion, and we couldn't have that, now could we?--DollarStoreBa'alConverse 18:27, 12 November 2025 (UTC)

Add comment'

Add comment'